Filing your Income Tax return under the Presumptive Taxation Scheme, specifically under Section 44AD or 44ADA, can streamline the process and reduce your compliance burden. However, there is one crucial point you need to be aware of to avoid complications and potential legal issues. Here’s what you need to keep in mind:

Gross Turnover and Reporting Requirements

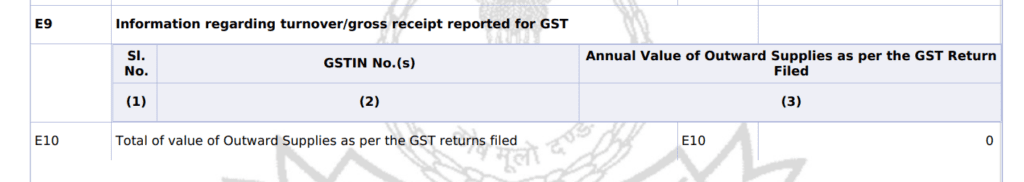

If your gross turnover exceeds 20 lakhs or 40 lakhs (may differ case to case basis) during the financial year under the Presumptive Taxation Scheme, it is imperative to report this in the appropriate section of your tax return. Specifically, you need to disclose this information under Table E9 of the form, titled “Information regarding turnover/gross receipt reported for GST.”

The Importance of GST Registration

Failing to report your gross turnover in Table E9 might be because you haven’t registered for GST. According to the GST Act, every supplier of goods and services, or both, is required to obtain GST registration if their aggregate turnover exceeds certain thresholds:

**20 lakhs for goods or services or both**

**40 lakhs for goods**

Consequences of Non-Compliance

If a GST officer determines that you were required to register under the GST Act but failed to do so the taxable person will be sent a show cause notice in FORM GST ASMT- 14 officer also have the authority to initiate Suo moto registration. This means the officer can register you for GST on their own accord, which can lead to several consequences, including potential penalties and backdated tax liabilities.

Practical Steps to Ensure Compliance

- Assess Your Turnover Accurately: Before filing your return, make sure to accurately calculate your gross turnover. If it exceeds the threshold limits, ensure that you have registered for GST.

- Complete Table E9: If your turnover surpasses 20 lakhs or 40 lakhs, accurately report this in Table E9 of your tax return form to reflect your GST obligations.

- Understand GST Registration Requirements: Familiarize yourself with the GST registration requirements. If your business activities fall within the specified thresholds, proactively register to avoid any legal complications.

- Consult a Tax Professional: If you are unsure about any aspect of your turnover or GST registration, consider consulting with a tax professional. They can provide guidance and ensure that you comply with all necessary regulations. “You can also connect with us to handle all your compliances with ease and in line with GST LAW “

Navigating the Presumptive Taxation Scheme can simplify your tax filing process, but it requires careful attention to detail, especially concerning GST registration and reporting. Ensuring compliance with these requirements not only helps you avoid penalties but also contributes to the smooth functioning of your business. By staying informed and proactive, you can manage your tax obligations effectively and maintain good standing with tax authorities to prevent yourself from unwanted notices.